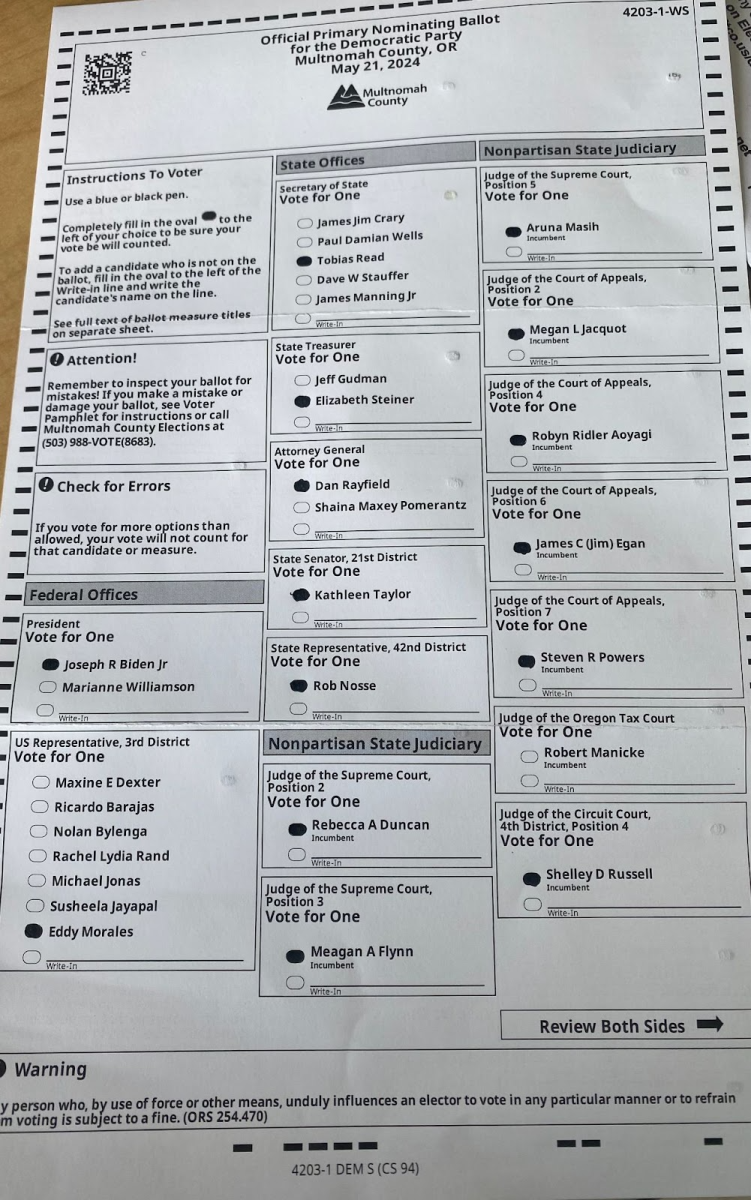

During the 2016 Oregon ballot election, Measure 97, a hotly debated corporate tax bill, was shot down by over 19 percent of voters. Attempting to increase funding for a myriad of programs, the measure hoped to grow Oregon revenue by imposing a greater sales tax on C-Corporations (businesses that pay their own taxes) earning over $25 million a year, and creating an expected $12.65 billion increase in revenue to the state. The dollars generated would have been placed into early childhood and K-12 education, health care, senior services, highways, and the general fund. The estimated per capita tax increase was expected to rise from $3,909 to $4,501, increasing income tax from 10.1 to 11.6 percent. However, the percentage of overall income tax would actually decrease, with percent of state revenue for income tax lowering from 68.7 to 55.1 percent, and corporate gross receipts increasing from 0.4 percent to 22.6 percent. Therefore, Oregon’s dependance on personal income tax would be lowered, but would still make up over 50 percent of the state’s tax revenue. The measure hoped to increase Oregon’s businesses taxes from 37.6 to 45.4 percent, as the national average for business tax is 45 percent of state taxes.

While the measure aimed to raise tax revenue by billions of dollars, a combination of over $47 million was raised by both political campaigns, making it the most expensive ballot measure in Oregon’s history. “Yes on 97,” the primary supporter of the measure, argued on five points: decrease class sizes, grow CTE programs in schools, increase healthcare affordability, provide seniors quality, in-home care, and “hold corporations accountable for their share.” On the other hand, “No on 97,” the lead opposition of the measure, argued that it would bring the largest per-capita tax increase in history, decrease jobs, hurt farmers and small businesses, tax gross sales instead of profit, and not guarantee that revenue would be spent on education, healthcare, and senior services.

Trent Lutz, Assistant Executive Director for Public Affairs at Oregon Education Association, backed the measure and is concerned by the impacts of its failure. “We continue to underfund many basic services across the board,” says Lutz, citing high homelessness rates, child hunger, and deficient social services. Lutz is also concerned about who is impacted most without Measure 97, saying “[Oregon] continue[s] to have the fifth largest class sizes in the U.S., low [levels of] CTE [programs], minimal language and elective programs, and high counselor caseloads.” Lutz’s concern lies mainly with students and public schools, one of the programs the measure would have funded.

Suzanne Cohen, Portland Association of Teachers President, is also disappointed by the failure of Measure 97. “That measure was going to do more than give a little money to our schools; it would have fully funded them,” Cohen says. The effects are felt district-wide, with higher class sizes and less in-school time, explains Cohen. If the measure had passed, students would’ve seen lower class sizes, more electives, P.E., arts, music, and CTE programs, greater mental health services, an increase in special education funding, and longer school years, something Oregon is known for lacking. With the funding, there would have also been more resources to address inequities.

Rebecca Tweed, former head of the “No on 97” campaign, takes a different stance on the measure. Tweed believes the major problem with the proposed bill was the lack of financial direction. “The proponents [of it] attempted to make it sound like the money [generated by Measure 97] would go to education, seniors, and healthcare, but it would really end up in the general funds,” Tweed says. “The fundamental legal problem with the measure was that it didn’t specify where the money would go.” Additionally, the taxing of corporate sales instead of profit would’ve passed the cost down to consumers, Tweed argues. Without exemptions for low income families and “cost of living going up as a blanket fee,” the measure would function like a sales tax, which Tweed believes Oregon is not in need of, and “hurt those who [Measure 97] was intended to help.” Tweed believes that gross receipts, or a tax on sales, is not what Oregon needs, citing a 40 percent increase in state revenue since 2011. “We don’t have a budget problem, we have a spending problem,” says Tweed.

Currently, there is no new corporate tax bill in the making in Oregon, or at least that the public is aware of. Although Measure 97 failed to please Oregonians enough to win the vote, many other bills such as Measure 98 and Measure 101 are assuredly improving the state’s education and healthcare systems.