College has always been expensive, but according to Forbes there has been a 180% price increase in four-year college tuition between 1980 and 2020. Moreover, the National Center for Education Statistics says the average price of a private nonprofit four-year college was approximately $37,600 in 2021. While a private four-year education is an option for some, it is not for all, so let’s explore a different option.

The Oregon Promise is a program that helps pay for community college. It helps students complete 90 credits that will go towards a degree in the end. These 90 credits could go towards an associate’s degree or the start of a four-year degree.

Currently, there is no cap on the number of people who can get the award, says Erin Rau, Deputy Director at the Office of Student Access and Completion in Oregon Promise. So far the state has funded anyone who qualifies, although this might change in the future if a colossal amount of people apply for the grant. Rau also says that since there is no application fee, it’s very smart to apply for the grant, even if it’s just a backup option. If you choose to go to a four-year college, it can be helpful to have a fallback. With the Oregon Promise Grant, there is no obligation to accept money that’s offered.

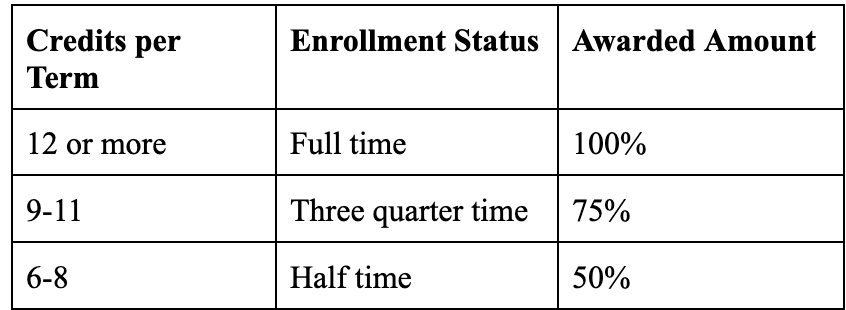

Although it’s hard to have the award revoked, it can happen. People have to maintain half-time enrollment, which means that they have to be enrolled in at least six to eight credits per term to continue receiving the award. It is also required to have continued academic progress towards the end goal of 90 credits. However, academic progress is decided college by college, meaning it could be different depending on the school someone plans to attend. This progress could be having to maintain a certain GPA or fulfilling a certain class requirement.

As an extension of the last point, it’s possible to transfer between colleges while maintaining the award. However, you would have to change what community college you attend on the form that you originally applied with. For example, if you wanted to switch from Portland Community College to Mount Hood Community College, you would have to change the information stated on your Free Application for Federal Student Aid (FAFSA) or Oregon Student Aid Application (ORSAA).

To qualify for a grant, an applicant must finish high school and get a diploma or have passed the General Educational Development (GED) test. In terms of alternate schooling, as long as someone has their diploma, they qualify. This applies to all students, whether they attended public or private school, were homeschooled, were in a correctional facility or in the foster care system.

For the purpose of eligibility, the applicant must have lived in Oregon for longer than 12 months. If the student is dependent on parents or guardians, all parties must be Oregon residents for longer than 12 months. To receive the grant, the applicant needs a minimum of a 2.0 GPA. This does not apply if the person chooses to apply after passing the GED test.

It’s crucial to complete FAFSA or ORSAA so that the school to which someone is applying will know if they should accept the student. The FAFSA and ORSAA applications give the information that schools need to know to allow a student into the program, like proof of residency. Filling out FAFSA or ORSAA is how you qualify for the grant. This has to be done by June 1 of an applicant’s senior year.

Following the completion of the FAFSA application or ORSAA, applicants go to the Oregon Promise website to make an account and fill out the questions. The application opens on Oct. 1. Making an account ensures that transcripts make it through to Oregon Promise and to the college that an applicant is applying to.

The amount of money awarded changes based on how many credits the student is taking at once. The minimum amount awarded to each student is $2000, but this money changes depending on whether or not you are a full or part-time student. Typically, full-time students are given the full award, whereas part-time students would get 50% because half-time students don’t need the money for courses that they aren’t taking. To receive any money, applicants must be enrolled for at least half time.

While the money from Oregon Promise is limited, the award can be used in conjunction with other grants to help pay for things other than just tuition. For example, according to Rau, a student could use a Federal Pell Grant to help pay, as well as using their Oregon Promise grant.

In the end, the Oregon Promise grant is an opportunity for furthering your education. It helps limit the number of student loans and money spent on college. Even if you plan to go to a four-year university, the COVID-19 pandemic has taught us that plans are always changing.