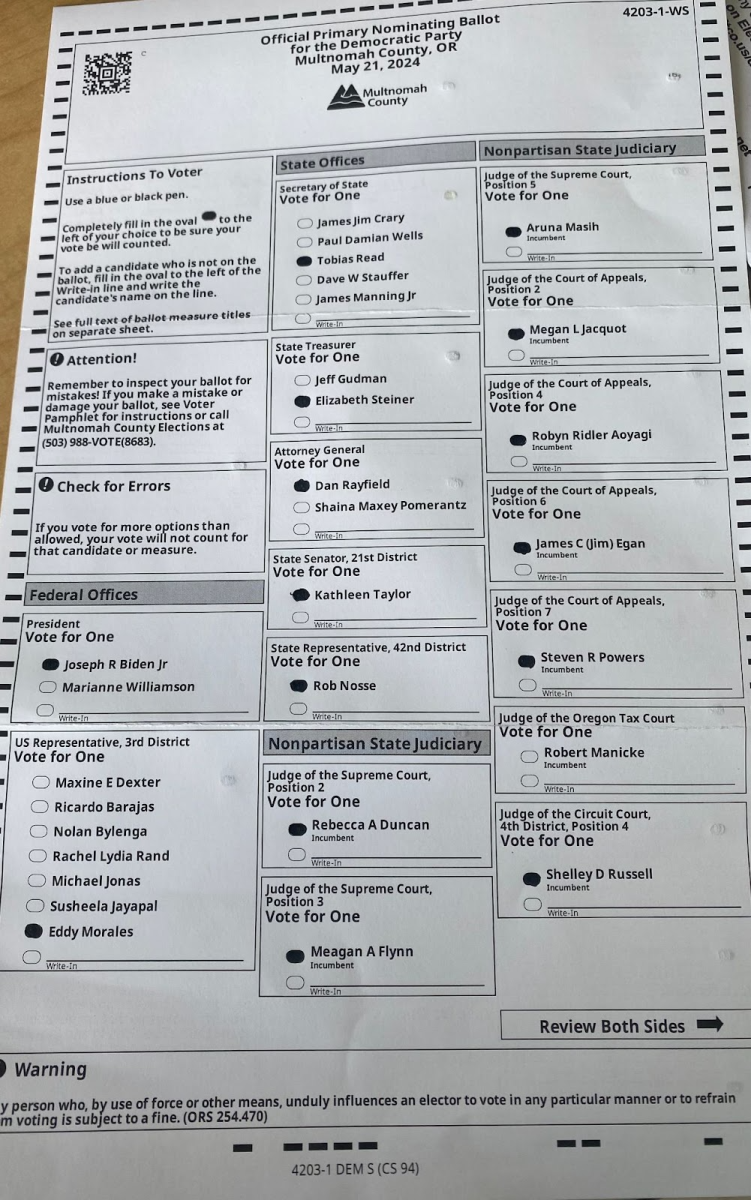

For the 2023-24 college application season, seniors will now navigate new changes within their college admissions process. These changes come as a result of the congressional decision to simplify the Free Application for Federal Student Aid (FAFSA), as well as the Supreme Court decision to add additional regulations on the information colleges may directly ask. Limited information is currently available about what will change in the FAFSA process — as the application’s opening has now been delayed — and as a result there is significant uncertainty on what exactly is new. The overall hope appears to be for a smoother, fairer, and more efficient application process.

Nearing November brings another round of seniors scrambling to finalize college applications. From the Common App, to the Coalition Application, to the UC system, individual colleges’ websites and more; college-bound seniors are left to navigate a variety of forms, questions, and essays to receive acceptance to the schools they may attend the following year. This year, the college application season consists of a myriad of changes, making the process increasingly hectic.

One form, essential for many students to afford their educational aspirations, is FAFSA. The FAFSA application has existed under a variety of names since 1965 as a way for the United States government to provide financial aid for students. FAFSA determines how much aid each student should receive and collaborates with colleges to determine a student’s overall owed tuition. For the upcoming application season, FAFSA has taken a new shape. Seniors will now navigate new deadlines and differing required information based on a new measurement— the student aid index (SAI), which replaces the past measurement of the expected family contribution (EFC). Although these changes feel sudden to many students, they have been brewing for years.

Steps to change FAFSA took place most recently in 2020, when the FAFSA Simplification Act was passed by Congress. As Regina Stanton, College Coordinator at Franklin High School, explains, there had been speculation over potential changes to the system for years. “A new FAFSA form was supposed to be rolled out this past school year, but the federal government needed more time.” Now, with the changes occurring, they seem to be aligned with the FAFSA Simplification Act. As Stanton states, there are updates to “the need analysis that determines federal aid eligibility, changes in terminology, and many policies and procedures for schools that participate in federal student aid programs.” As of now, with the application not yet released, there is minimal concrete knowledge about what exactly differs. However, as Stanton reassures: “These changes are supposed to make the FAFSA simpler and easier for students and families to complete.”

Though attempting to simplify, the lack of information surrounding what’s new has made the application process feel even more complicated to some. As senior Sanora Bruin expresses: “[FAFSA], like all other parts of college apps, is confusing and scary.” Franklin senior Stephen Do expands on this, explaining that it now “feels inconsistent.” With little information to go off, some students are worried about what aid they will receive.

One confirmed change is the altered deadline, which has increased worries for many students applying early action and early decision. Previously opening in October, one month before the most common early deadline, FAFSA now opens in December, a month after the deadline, and less than a month before many colleges promise to send out early acceptances. Many students applying early are now worried about what this will mean for the financial package, and if colleges will have adequate time to process their FAFSA application and provide the aid package they need. As Emilia Cafiso, a senior at Lincoln High School, states, “[I’m] upset they pushed the open[ing of FAFSA] to December.” One anonymous Franklin senior elaborates, “it’s nerve wracking because of the early decision stuff, will they have time to actually look [at my FAFSA application]?” Stanton, in response, explains that reaction to and cooperation with this change will depend on each school. Visiting admissions representatives Stanton spoke with confirmed this, many stating that either “[college’s] financial aid departments will work as quickly as they can to process FAFSA applications” or “they will take into consideration the delay in FAFSA opening for those applying for early admission.” In each case, she encourages students with concerns to “reach out to the financial aid department of the college they are applying to.”

The variation in effects seems to be a consistent trend with the potential changes to the college system as a whole. It is now known FAFSA will no longer take into consideration the amount of other family members in college, which makes finances even more worrisome for many families juggling multiple tuitions. Stanton explains that this “means families with multiple college students could receive less aid for the 2024-25 school year.” However, as Stanton elaborates, this does not mean there is no way for colleges to consider the amount of students a family is paying for; “schools can adjust offers at their discretion, considering the financial burden of having many students in school.”

In addition, a similar change has occurred with the Supreme Court ruling that colleges may no longer consider race when admitting students. This has raised worries of many, as previously consideration of race was used to increase representation and opportunities for many historically underserved students to attend university. Colleges are now taking different approaches to increasing campus diversity. Stanton learned more about this at the annual National Association of College Admissions Counselors (NACAC) conference in September, through a workshop entitled Equity in Higher Education: Post-Affirmative Action Implications and Strategies for Change. There she was informed that “schools can still articulate a mission and goals around diversity for their respective campuses and have programs to support diverse students on their campuses [and] students are still able to share their lived experience in an essay,” which can address race. Furthermore, “the decision does not change the precedence around outreach and recruitment to underrepresented groups.”

Stanton empathizes with worried students, saying, “don’t get frustrated. Use [extra] time [to] finish your college applications, start applying for scholarships, etc.” and reiterating that she “and other school staff that support FAFSA completion at Franklin will be in a similar position as students and families this school year in terms of this being a new application that none of us have used.” Students, staff, and families will all have to relearn the system together. For now, there are some steps students and families can take until FAFSA is released. Stanton explains that “You can get ready for the FAFSA now by completing your FSA ID and having your parent/guardian complete theirs [too]. You can set up an FSA ID on the StudentAid.gov website by providing their birth date, Social Security number and full name.” A notable potential negative is presented with access, as Stanton explains that “FAFSA now requires a parent/guardian to create a FSA ID.” Students no longer have access to fill out this parent/guardian portion of the financial aid application. However, with such little information known currently, further insight into the process may show solutions.

For help with the process, there will also be many resources for students. “Starting on October 26th [Franklin] will be starting [the] regular Thursday FAFSA help sessions at 1:00 pm (1:30 pm tutorial days) in the College & Career Center… to help students and/or families set up FSA IDs, and once the FAFSA opens in December use this time to support students with completing the new FAFSA form,” says Stanton. Furthermore, a document created by Stanton, articulating major changes, will be shared with seniors and their families by the end of October.

As always, so much of financial aid and acceptance will depend on individual schools and each individual student. Reaching out to future schools’ departments can be beneficial for students with questions. In regards to the Supreme Court decision, students can be best informed by contacting admissions, and in terms of FAFSA they may benefit from contacting the financial aid department. Or, as Stanon provides, students can contact the Federal Student Aid Information Center (FSAIC) who are available by live chat, phone or email and can be found at https://studentaid.gov/help-center, contacted by phone at 1-800-433-3243 or reached through email on their website.