Oregon has a very, very large financial problem. Billions in debt, and no solid plan for recovery. A whole 28 percent of its biennium budget is dedicated to this problem. Military or infrastructure spending may be the first that come to mind when liabilities of 22 billion dollars are mentioned, but this debt is attributed to something you’ve probably never heard of: the Public Employees Retirement System (PERS).

How The System Works:

PERS has existed for nearly 100 years, and during that time it has accumulated a lot of debt. It has been required by law to pay every single public employee that has retired after 1935, causing massive debt when the system doesn’t have the money to pay the retirees. PERS is a pension system for public employees. A pension system, as defined by Jon Chesbro, a professor of economics at Oregon State University, is simply money an employee sets aside over the course of their career, to be retrieved at retirement. “It’s essentially just a pool of money paid into with premiums [or] by part of your paycheck.” However, it’s a little more complicated when you get down to the details, Chesbro explains. When you pay money into a pension fund, as they are referred to, you are paying into a ‘pool’ of money that consists of every other person’s money who pays into that pension. For example, if you work for an energy drink company that has a pension plan, you would be paying into the same fund as all of your coworkers, and when retirement rolls around, you start taking a (usually) monthly benefit out of that fund until the day you die (or a selected period of time, if you opt for that payment method).

After the money is put into this fund, the vast majority of the time, that money is invested in other private companies and government issued bonds. The investments are arguably the most important part of the whole system.

The History Of PERS And Debt:

Before the era of PERS, way back in 1935, The Federal Insurance Contributions Act, or FICA, was enacted in conjunction with the Social Security Act. Both were hugely important bills that are still in effect and responsible for many standing government institutions. FICA and MedFICA gave the government the ability to take a certain amount out of your paycheck to be used for medicare and social security. This is called a payroll tax, and across the US today, about 12 percent is taken out to be used for Social Security.

In the early years of PERS, the system was relatively small, only being signed into legislation in about 1946. The first state that issued this new bill was California, opting to pay workers generous benefits after retirement as an incentive to work for the government and in hopes that it would create a stronger social safety net. The benefits designated by the government were seen as too little for people working. From 1946 to around 1976, public workers protested, demanding higher benefits during retirement. The government agreed to this, taking a little more out of the salary of each individual working for the government, and matching that amount taken out in some cases, increasing the money going into funding PERS. On top of this, the federal government promised a ‘guaranteed rate of return,’ a very vital piece of legislation.

Prior to this decision, the government did not have any guarantee to pay the employee their money if the market were to crash, or if the money in the fund were to suddenly disappear into thin air. In those cases, the employee would just have to deal with this loss. When the guaranteed rate of return was passed, however, it made it so that the government would have to pay the retirement of every single state employee regardless of what the market did, or what happened to the money inside the fund. This would make it so that even if the amount in the fund reached zero dollars, the government would still be on the hook for the guaranteed payout at retirement.

The only way to increase profits as much as needed would be to invest in riskier capital. Riskier investments bring hopes of larger returns. So the treasury department in every state decided to go with this option, investing in much more volatile but cash-filled markets like technology and oil.

And this strategy worked, putting money in risky stocks, and getting high returns. Money in the funds were making substantial profits from 1975 to the early 2000s, especially during the start of the stock market bubble in the 1990s. But during the beginning of the 2000s, the markets failed.

In the start of 2001, in the internet sector of investing, prices and demand were soaring way past the realistic value of these stocks. By the end of 2002 the market had burst, crashing by a mind-boggling 78 percent. It carried with it the PERS portfolio, leaving funds decimated. The amount in those funds had dropped far below what the guaranteed rate of return promised, leading to a national Public Pension debt of over 1.2 trillion dollars. Yet the guaranteed rate of return was still present. Public employees working at that time were afraid that their entire retirement would be in jeopardy, and unfortunately for them, they were right.

Just six years after the original crash, when the PERS funds were still struggling to find any sort of fiscal foothold, the markets were hit with yet another bubble and subsequent crash. This time, it was the 2008 housing bubble. The Dow Jones Industrial Average, one of the largest trading companies, fell 778 points, an agonizing figure for anyone working in the public sector and looking to retire anytime soon.

With 2.28 trillion dollars stowed away to cover 2.94 trillion dollars in long-term liabilities in 2008, this left about a 660 billion dollar gap, according to an analysis by the Pew Center on the states. Assets totaling 31 billion dollars were left to pay off 638 billion dollars in liabilities. It’s important to keep in mind that the money in these PERS funds is designed to pay out in the long-term, in the realm of 30 to 40 years, based on something called ‘target fund dates,’ which are the dates during which certain groups of employees are supposed to start receiving their benefits.

Heather Case, a senior policy advisor at Oregon PERS, describes an extra fund called the Individual Account Program (IAP) which applies to all PERS employees. “It’s a lump sum program,” she says. “The [IAP] is kept for the individual employee,” she says, meaning it’s not connected to any sort of group fund created by PERS. “When you retire, your IAP account does not have any designated rate of return, so whatever happens to that money, whether it goes up or down, will be what you get, and you are allowed to take it out in whatever way you want, periodically, or all at once. Those 2 funds, your current tier and your IAP, make up your full retirement.”

Who Controls The Money?:

When an employee’s money is paid into the pension, a group of individuals decides exactly where to put this money. In the private sector, it is the fund managers who make these decisions. In government institutions, it is always the state/local treasurer and/or Treasury Department who decides how to invest the money.

According to Chesbro, in many private companies, as well as many states’ PERS programs, the work of deciding where to invest this PERS money is sometimes off-loaded to other private investment companies. A very large part of their job is dedicated to determining where to invest this money. As one gets closer to retirement, the investments that the treasurer selects tend to become much more conservative and safe (with lower payoffs), attempting to stabilize retirement funds. That 22 billion dollar liability mentioned earlier, however, is mostly a result of stock market down-turns that took a huge chunk of invested funds.

The graph at this link (from The Federal Reserve’s website) shows the assets versus liabilities from 2002 to 2017 of PERS.

A Tier Based System:

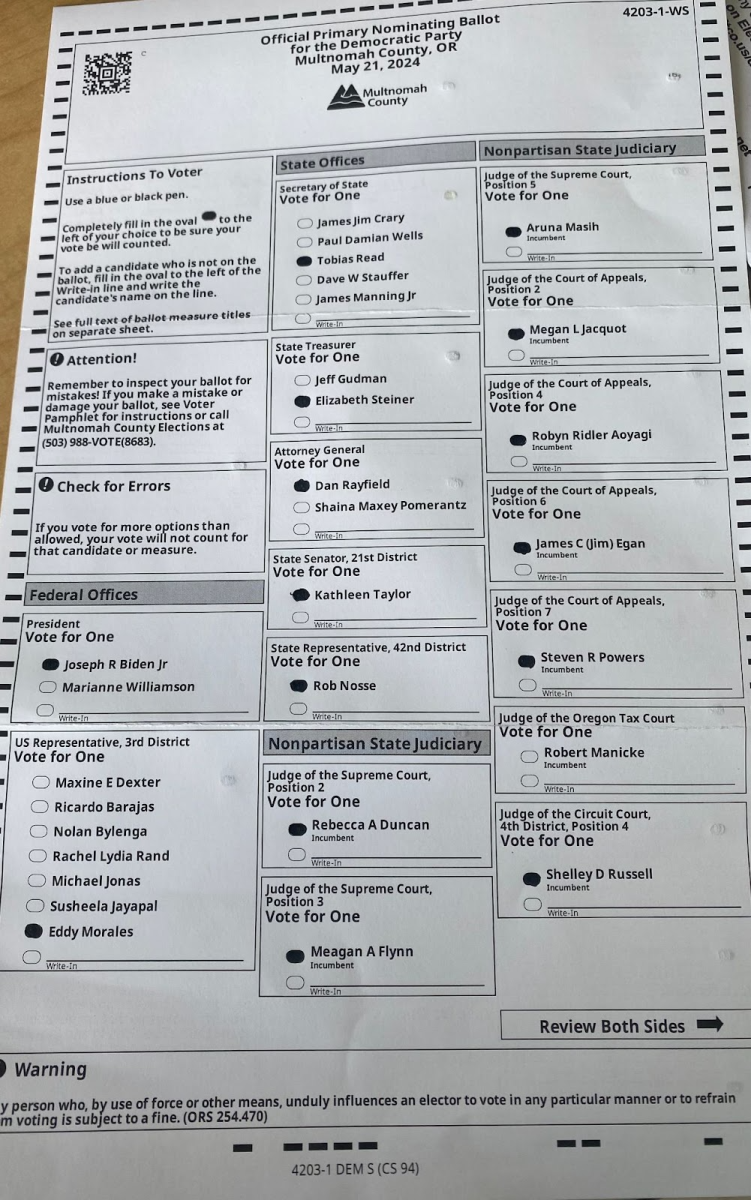

Currently, there are 3 different layers to PERS. The tiers vary from state to state, so we’ll just look at Oregon’s. Tier 1, requires the employee to have started working on or before 1961. Tier 2 entry date is 1986, and Tier 3, called the Oregon Public Service Retirement Plan (OPSRP), entry date is any time after about 2003.

Case explains, “You get different benefits based on what level you are in on this pension, so Tier 1 people get the highest [because] they were promised more than everybody else.”

She adds, “The Supreme Court has ruled through a number of cases that basically said we (PERS) cannot change the laws or legislation regarding the guaranteed rate of return.” She says that the important part of the legislation is the actual calculation of how much the benefit will be at retirement. This is a difficult calculation that accounts for different factors like inflation and beneficiaries.

“Tier 2 has about the same benefit as Tier 1 because Tier 2 is such a small group…OPSRP is the one that most of us public employees now are in, and there is currently no guaranteed rate of return for us,” said Case.

How Do We Pay Off This Debt?:

When the Tier 2 employees retire, there might not be enough money to pay them. In the past, PERS has used funding for schools, or other publicly funded areas of government to restore the funds. There are still solutions to the liability though. In 2004, the staff of CalPERS presented the board with possible solutions, among them being a reduction in promised benefits for later tiers, and increasing contributions from members of CalPERS and all tax-paying residents of California. Solutions cannot simply be implemented as soon they are found, however. Any legislation or major reform would not only have to go through the state senate but also public unions, as they possess a great deal of say in decisions regarding new bills.

Recap:

PERS has a massive debt incurred after many years of promises that failed in the wake of financial crises and poor investment decisions. The current state of Oregon PERS lacks a solid plan to shake the debt, and taxpayers who are not working for public agencies are required to pay for 30-year retirement plans. There may still be hope, but as of today, with 22 billion dollars in liabilities and the recent COVID-related financial crisis, there is still a long way to go.