This is an unprecedented time. Nothing quite like this has ever happened. We are facing the possibility of an economic downturn, all driven by the fear of COVID-19. Ever since the coronavirus reached the United States, and even before that, the market has been taking a large hit. On March 16, the DJIA(Dow Jones Industrial Average) dropped 3,000 points, nearly 13 percent, and the NASDAQ had its worst day in history. This trend is following weeks of declines, intermittently highlighted by glimpses of a market rebound. It seems as if every week we have had a day where the market bounces back, only to have those gains wiped clean the next day.

The new norm seems to be that the market is breaking its largest point losses time and time again. With these losses, we have entered a bear market. This is when the market loses 20 percent of its value or more, relative to recent highs. These losses are caused in part by panic selling, due to fears over the coronavirus. Panic selling happens when due to recent world events, investments are not seen as financially viable so investors then sell off those assets. In the case of the coronavirus, this fear made the market drop, which snowballed and caused more people to sell. When more people sell, the market drops yet again. This is a continuous negative cycle that causes the market to plummet. Timothy Biamont, the business teacher at Franklin High School, says that most people don’t need their money in the short-term, so the consensus from financial professionals is to stay put and avoid straying from any investment plans.

In the case of a large market drop of over seven percent, a circuit breaker is triggered, which halts all trading for fifteen minutes. If the market drops 13 percent in a single day, then this 15 minute halt happens yet again. In the case that the market drops twenty percent, then all trading is halted for the remainder of the day. This has only ever happened once, on “Black Monday” October 19, 1987. This was the highest percentage loss ever. These circuit breakers are in place to help prevent a large market crash, as well as to allow traders to get their bearings if the market has crashed extremely fast.

With this in mind, these circuit breakers are a rare occurrence. One was triggered in 1997, and none had been triggered for over 20 years, until now. So far, four of these breakers have been triggered since the start of March. This shows how much of an impact the coronavirus has had on our markets. With such a downturn in the stock market, Biamont says that “We [investors] are simply looking for good news.” What he says is that “investors are looking for a time when fewer people are getting infected, a successful vaccine, and/or monetary stimulus and a general restarting of our economy.” However, it is difficult and nearly impossible to tell when these factors could occur. One of these factors has been achieved so far.

With the market taking such a large hit, the government has introduced a bill which, if passed, would inject money into all markets. This money will help keep parts of our economy functioning, as well as giving some people valuable stimulus money. This stimulus package, estimated to be over 1.8 trillion dollars, was blocked in the Senate on March 22. On this same day, US stock futures fell five percent, the maximum they can fall outside of regular trading hours. However, on March 25, a revised bill was passed that will funnel two trillion dollars into the market. This will be the largest fiscal stimulus package in US history. Biamont says that while stimulus packages like this help restart the economy, they further expand the federal deficit. Our nation’s debt is already 24 trillion dollars, and that’s before any further debt due to a financial aid package. Higher national debt means that our country owes more money to its creditors. This means that in times of large, or increasing debt, our country will have little economic growth. This also leads to rising interest rates, as well as possible increases in taxes to help pay off our debt.

However, this large plummet in the economy doesn’t just have effects on the stock market. With fears of the coronavirus spreading, millions are being forced to stay home. This is causing businesses to take a massive hit. On March 16, Oregon governor Kate Brown ordered all bars and restaurants to close. Most restaurants have slight profit margins. Because of their small profit margins, restaurants will be massively impacted after being ordered to close for weeks on end. The spread of the virus also means that large amounts of workers are being laid off, to contain transmission.

Biamont says, “Unfortunately, many will not recover from this setback, but hopefully a fiscal stimulus package will allow them to open back up for business in a few weeks.” Luckily, on March 30, Portland announced that it will begin an aid program to assist small businesses and low-income individuals. This came soon after the President listed Oregon as one of the states available for emergency protection aid. However, even with markets seemingly rebounding, and financial aid becoming available, this is not a time to become complacent. Biamont believes we are headed into a recession. He says, “The virus has reduced spending, slowed our economy, and wiped out our forecasted economic expansion for this year.” He believes it will be very difficult to avoid a recession, but hopes “that the recession will be short-lived because our economy was very strong going into this recent crisis.”

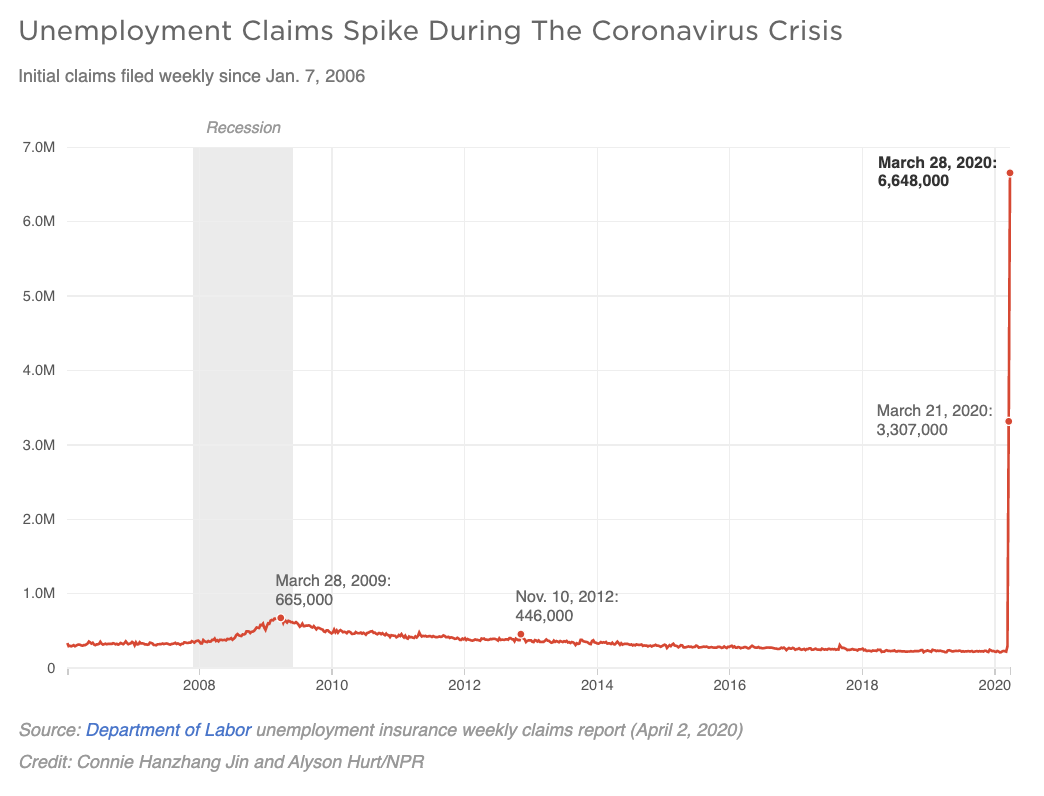

With this being such an unusual time, we have no concrete idea of how this will affect our country. While we do know that many people will lose their jobs, and prices are unpredictable, we don’t know the exact extent. Recently, 6.6 million people filed jobless claims to gain benefits, with 700,000 newly unemployed in March. On March 22, the Federal Reserve Bank’s James Bullard said that the US unemployment rate could soar to 30 percent. While this is an extreme estimate, it is possible. Luckily, programs are being put in place to help businesses and workers affected by COVID-19. This means that hopefully, even with the US’s slow response to the virus, we can diminish the effects the coronavirus will have on our country. This also means that with businesses feeling the full effects of the coronavirus, they need help more than ever. Many restaurants and food businesses around Portland are still providing takeout or delivery orders. If it is at all possible, as well as safe to you and those around you, I strongly encourage you to help our local businesses through this time by buying from them or donating, to help them stay open.